Inverted Hammer Candlestick Pattern: A Comprehensive Guide

Introduction

In the realm of technical analysis, candlestick patterns serve as invaluable tools for deciphering market sentiment and predicting potential price movements. Among these patterns, the Inverted Hammer stands out as a notable indicator of potential bullish reversals, offering traders valuable insights into market dynamics. In this detailed article, we delve into the intricacies of the Inverted Hammer pattern, exploring its formation, significance, and strategies for effective utilization in trading.

Understanding the Inverted Hammer Pattern

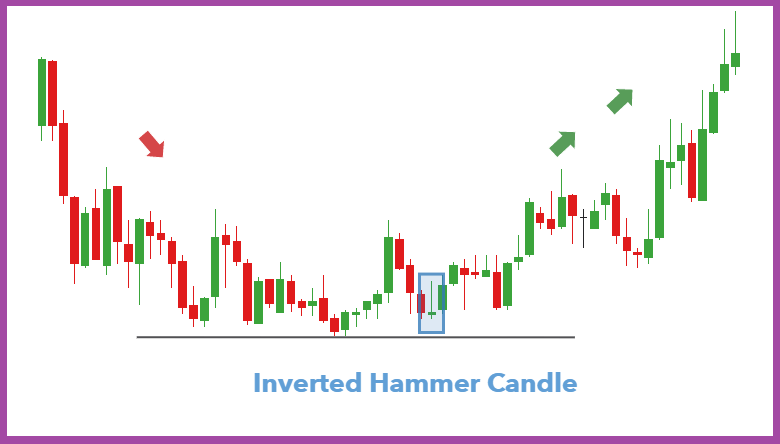

The Inverted Hammer is a single candlestick pattern characterized by its distinctive appearance, resembling an upside-down hammer. This pattern typically occurs at the end of a downtrend and signals a potential reversal to the upside. Key features of the Inverted Hammer include:

- Long Upper Shadow:

- The Inverted Hammer has a small body located near the lower end of the trading range, with a long upper shadow extending upwards.

- Short or Non-existent Lower Shadow:

- The lower shadow of the Inverted Hammer is either short or non-existent, indicating minimal price movement below the opening price.

- Opening and Closing Prices:

- The opening and closing prices of the candlestick are typically close together, with the opening price slightly lower than the closing price.

Formation Criteria

For an Inverted Hammer pattern to be considered valid, it must meet the following criteria:

- The market should be in a downtrend before the pattern occurs.

- The candlestick should have a small body near the lower end of the trading range.

- The upper shadow should be significantly longer than the body, ideally at least twice the length of the body.

- The lower shadow should be short or non-existent.

Deciphering the Psychology Behind the Inverted Hammer

Understanding the psychology behind the Inverted Hammer pattern is crucial for interpreting its significance and potential implications. Here’s a breakdown of the psychological dynamics at play:

- Initial Bearish Pressure:

- The Inverted Hammer forms after a downtrend, with sellers dominating the market and pushing prices lower.

- Rejection of Lower Prices:

- As the price moves lower during the trading session, buyers step in and push the price higher, resulting in the formation of the long upper shadow.

- Potential Reversal Signal:

- The appearance of the Inverted Hammer suggests that despite the initial bearish pressure, buyers were able to regain control and push the price higher by the close of the session. This reversal in momentum hints at a potential shift from bearish to bullish sentiment.

Significance of the Inverted Hammer in Trading

The Inverted Hammer pattern holds significant importance for traders due to several reasons:

- Bullish Reversal Signal:

- The Inverted Hammer serves as a strong bullish reversal signal, indicating a potential end to the prevailing downtrend and the beginning of an uptrend. Traders interpret this pattern as a signal to enter long positions or exit short positions.

- Confirmation of Trend Reversal:

- When observed at the end of a downtrend, the Inverted Hammer provides confirmation of a potential trend reversal. It helps traders identify turning points in the market and adjust their trading strategies accordingly.

- Market Sentiment Shift:

- The emergence of Inverted Hammers reflects a shift in market sentiment from bearish to bullish. It suggests that buyers are stepping in to support the price, potentially leading to sustained upward movement.

- Versatility Across Timeframes:

- The Inverted Hammer pattern is applicable across various timeframes, from intraday charts to longer-term charts. This versatility allows traders to identify reversal signals across different trading horizons.

Trading Strategies Involving the Inverted Hammer

Traders can employ several strategies to capitalize on the potential of the Inverted Hammer pattern:

- Confirmation with Volume:

- Confirm the Inverted Hammer pattern with an increase in trading volume on the bullish candlestick. Elevated volume provides validation of the pattern and strengthens the bullish reversal signal.

- Support and Resistance Levels:

- Look for Inverted Hammers forming near key support levels, as this confluence increases the pattern’s reliability. Similarly, the presence of resistance-turned-support levels enhances the bullish reversal signal.

- Moving Averages:

- Use moving averages to confirm the reversal of the downtrend. When the Inverted Hammer pattern occurs near a long-term moving average, it reinforces the bullish reversal signal, especially if accompanied by a bullish crossover.

- Entry and Exit Points:

- Enter long positions at the close of the Inverted Hammer candlestick and set stop-loss orders below the low of the pattern. Take profit levels can be set based on resistance levels or using a trailing stop-loss strategy.

Practical Example of Inverted Hammer

Imagine a scenario where a stock has been experiencing a prolonged downtrend, characterized by consecutive bearish candlesticks dominating the price action. Suddenly, an Inverted Hammer pattern emerges, with a small body near the lower end of the trading range and a long upper shadow. Traders who identify this pattern interpret it as a potential reversal signal and may enter long positions, anticipating a shift in the trend direction.

Pros and Cons of Inverted Hammer

Pros

- Strong Reversal Signal:

- The Inverted Hammer pattern is a robust indicator of a potential bullish reversal, providing traders with a clear signal to enter long positions after a downtrend.

- Confirmation of Trend Reversal:

- The pattern offers confirmation of a trend reversal when observed at the end of a downtrend, aiding traders in making informed trading decisions.

- Versatility Across Timeframes:

- The pattern is applicable across various timeframes, allowing traders to identify reversal signals across different trading horizons.

Cons

- Potential for False Signals:

- Like any technical pattern, the Inverted Hammer may occasionally produce false signals, especially in choppy or volatile markets, leading to premature entries or exits.

- Context Dependency:

- The effectiveness of the pattern depends on its context within the broader market trend and conditions. Traders must consider other technical indicators and market factors to validate the pattern’s significance.

- Risk Management:

- While the pattern provides a clear entry signal, traders must implement proper risk management strategies to mitigate potential losses, including setting stop-loss orders and managing position sizes.

Conclusion

The Inverted Hammer pattern stands as a formidable tool in the arsenal of technical analysts, offering invaluable insights into potential bullish reversals in the market. Its visual simplicity, coupled with its robustness as a reversal signal, makes it a favorite among traders seeking to identify opportune entry points amidst market uncertainty. By mastering the intricacies of the Inverted Hammer pattern and integrating it into their trading strategies, traders can enhance their ability to navigate the dynamic landscape of financial markets and capitalize on emerging trends.

In essence, the Inverted Hammer pattern represents more than just a candlestick formation; it symbolizes the delicate balance between bullish and bearish forces in the market. Through its formation, traders gain a glimpse into the shifting dynamics of supply and demand, enabling them to anticipate potential trend reversals and position themselves accordingly. However, it’s imperative to approach trading with caution and diligence, recognizing that no pattern guarantees success in isolation. By combining the insights gleaned from the Inverted Hammer pattern with a comprehensive understanding of market fundamentals, risk management techniques, and other technical indicators, traders can strive for greater consistency and profitability in their trading endeavors.

EDUBRUG is a top educational institute known for offering the best stock market courses in India. Our goal is to make financial markets easy to understand and help people learn about trading. Eduburg has quickly become a popular choice for those who want to become successful traders and investors. Our experienced faculties, who are certified, provide practical training in stock trading, technical analysis, and financial planning. Eduburg is dedicated to providing high-quality education, ensuring that our students gain the skills and confidence needed to succeed in the stock market.