Understanding the Bullish Counterattack Candlestick Pattern: A Comprehensive Guide

Introduction

The Bullish Counterattack pattern is one such pattern that signifies a potential reversal of a downtrend, indicating the emergence of bullish sentiment. This comprehensive guide aims to elucidate what the Bullish Counterattack pattern entails, how it forms, its significance, and strategies for traders to effectively integrate it into their trading methodologies.

What is the Bullish Counterattack Pattern?

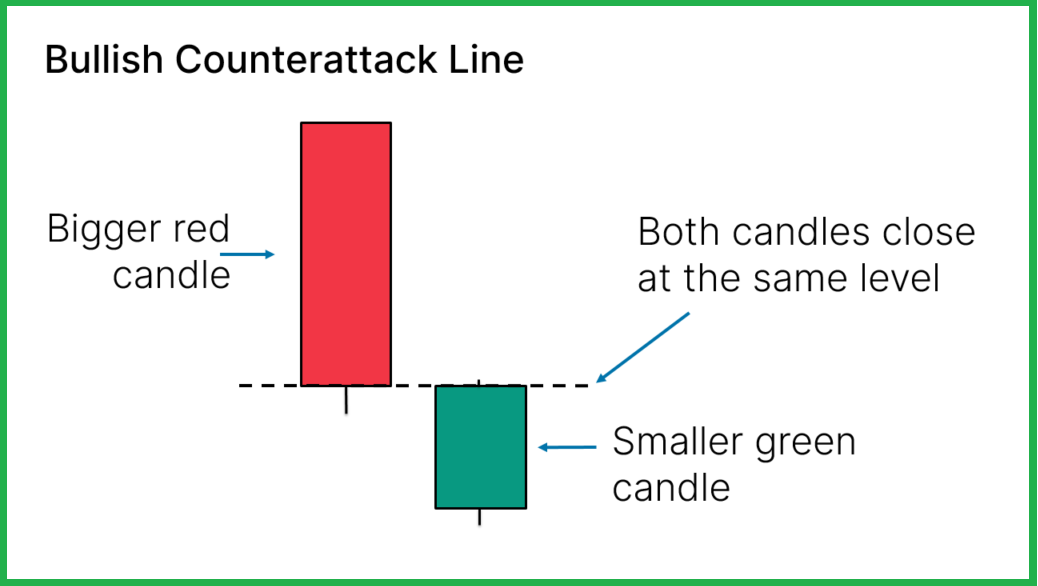

The Bullish Counterattack pattern, also known as the Bullish Engulfing pattern, is a two-candlestick pattern that materializes during a downtrend. It suggests a potential reversal of the prevailing bearish sentiment and a shift towards bullish momentum. The pattern comprises the following components:

- First Candlestick (Bearish):

- The first candlestick is a long bearish (red or black) candlestick, reflecting the dominance of sellers and the continuation of the downtrend.

- Second Candlestick (Bullish):

- The second candlestick is a long bullish (green or white) candlestick that completely engulfs the body of the preceding bearish candlestick. This bullish candle signifies a strong buying interest, overpowering the previous selling pressure.

Formation Criteria

For a Bullish Counterattack pattern to be considered valid, it must adhere to the following criteria:

- The market should be in a downtrend before the pattern emerges.

- The first candlestick should be a long bearish candlestick.

- The second candlestick should be a long bullish candlestick that completely engulfs the body of the first candlestick.

Psychology Behind the Bullish Counterattack Pattern

Understanding the psychological dynamics underlying the Bullish Counterattack pattern aids traders in comprehending its significance:

- Initial Bearish Sentiment:

- The first candlestick reflects the prevailing bearish sentiment, with sellers dominating the market and pushing prices lower.

- Sudden Surge in Bullish Momentum:

- The emergence of the second candlestick, a long bullish candlestick that engulfs the entire body of the preceding bearish candlestick, signifies a sudden surge in bullish momentum. This indicates a shift in market sentiment, with buyers stepping in forcefully to reverse the downtrend.

- Reversal of Market Dynamics:

- The Bullish Counterattack pattern symbolizes a reversal of the prevailing market dynamics, transitioning from bearishness to bullishness. It suggests that buyers have regained control, potentially leading to a trend reversal.

Significance of the Bullish Counterattack Pattern

The Bullish Counterattack pattern holds significance for traders due to several reasons:

- Reversal Signal:

- It serves as a potent signal for a potential reversal of a downtrend, indicating a shift towards bullish sentiment.

- Confirmation of Bullish Momentum:

- The pattern confirms the emergence of bullish momentum, validating the prospects of a bullish trend reversal.

- Entry Point for Traders:

- The Bullish Counterattack pattern presents an opportune entry point for traders seeking to capitalize on the anticipated bullish reversal.

Trading Strategies Using the Bullish Counterattack Pattern

Here are some strategies traders can employ to effectively utilize the Bullish Counterattack pattern:

- Confirmation:

- Wait for confirmation following the formation of the Bullish Counterattack pattern. Confirmation may entail monitoring subsequent price action and volume to validate the bullish reversal.

- Combine with Technical Indicators:

- Supplement the Bullish Counterattack pattern with other technical indicators such as moving averages, RSI (Relative Strength Index), or MACD (Moving Average Convergence Divergence) to enhance the robustness of the trading signal.

- Identify Key Support Levels:

- Identify key support levels in proximity to the Bullish Counterattack pattern, as these levels may act as additional confirmation points for the bullish reversal.

- Implement Stop-Loss Orders:

- Employ stop-loss orders to manage risk effectively. Place stop-loss orders below the low of the Bullish Counterattack pattern to mitigate potential losses in case of a reversal failure.

- Plan Entry and Exit Points:

- Strategically plan entry and exit points based on the confirmation of the bullish reversal and consider setting profit targets to capitalize on potential price movements.

Example of the Bullish Counterattack Pattern

Consider a scenario where a stock has been experiencing a prolonged downtrend. Here’s how the Bullish Counterattack pattern might manifest:

- Day 1 (Bearish Candlestick):

- The stock opens at $50 and closes at $45, forming a long bearish candlestick indicative of the prevailing downtrend.

- Day 2 (Bullish Counterattack):

- The stock opens at $45 and closes at $55, forming a long bullish candlestick that completely engulfs the body of the preceding bearish candlestick. This Bullish Counterattack pattern signals a potential reversal of the downtrend.

Pros and Cons of the Bullish Counterattack Pattern

Pros

- Clear Reversal Signal:

- The Bullish Counterattack pattern provides a clear and identifiable signal for a potential bullish reversal, aiding traders in decision-making.

- Confirmation of Bullish Momentum:

- The emergence of the pattern confirms the presence of bullish momentum, offering validation for traders anticipating a trend reversal.

- Strategic Entry Point:

- The pattern presents traders with a strategic entry point to capitalize on the anticipated bullish reversal, facilitating advantageous positioning in the market.

Cons

- Need for Confirmation:

- Confirmation following the formation of the Bullish Counterattack pattern is imperative to validate the bullish reversal signal, which may require additional time and analysis.

- Potential False Signals:

- Like any technical pattern, the Bullish Counterattack pattern may yield false signals, necessitating cautious evaluation and confirmation before executing trades.

Practical Considerations for Trading the Bullish Counterattack Pattern

- Volume Analysis:

- Accompany the Bullish Counterattack pattern with volume analysis to gauge the strength of the bullish reversal. Higher trading volume accompanying the pattern enhances its validity.

- Market Conditions:

- Consider prevailing market conditions and overall trend dynamics when interpreting the Bullish Counterattack pattern. It may be more reliable in stable market environments with clear trends.

- Risk Management:

- Prioritize risk management by implementing stop-loss orders and adhering to predefined risk-reward ratios to safeguard against potential losses.

- Continuous Learning:

- Engage in continuous learning and refinement of trading strategies to adapt to evolving market dynamics and enhance trading proficiency.

Conclusion

The Bullish Counterattack pattern serves as a valuable tool for traders seeking to identify potential bullish reversals amidst downtrends. By understanding its formation, significance, and strategic implications, traders can enhance their ability to navigate the financial markets effectively. However, it is essential to exercise prudence, patience, and rigorous risk management when integrating the Bullish Counterattack pattern into trading strategies.

Successful trading entails a holistic approach encompassing technical analysis, risk management, and continual learning. By incorporating the Bullish Counterattack pattern into their repertoire and refining their trading methodologies, traders can bolster their decision-making capabilities and strive towards achieving consistent trading success.

EDUBRUG is a top educational institute known for offering the best stock market courses in India. Our goal is to make financial markets easy to understand and help people learn about trading. Eduburg has quickly become a popular choice for those who want to become successful traders and investors. Our experienced faculties, who are certified, provide practical training in stock trading, technical analysis, and financial planning. Eduburg is dedicated to providing high-quality education, ensuring that our students gain the skills and confidence needed to succeed in the stock market.