Understanding the Shooting Star Candlestick Pattern: A Comprehensive Guide

Introduction

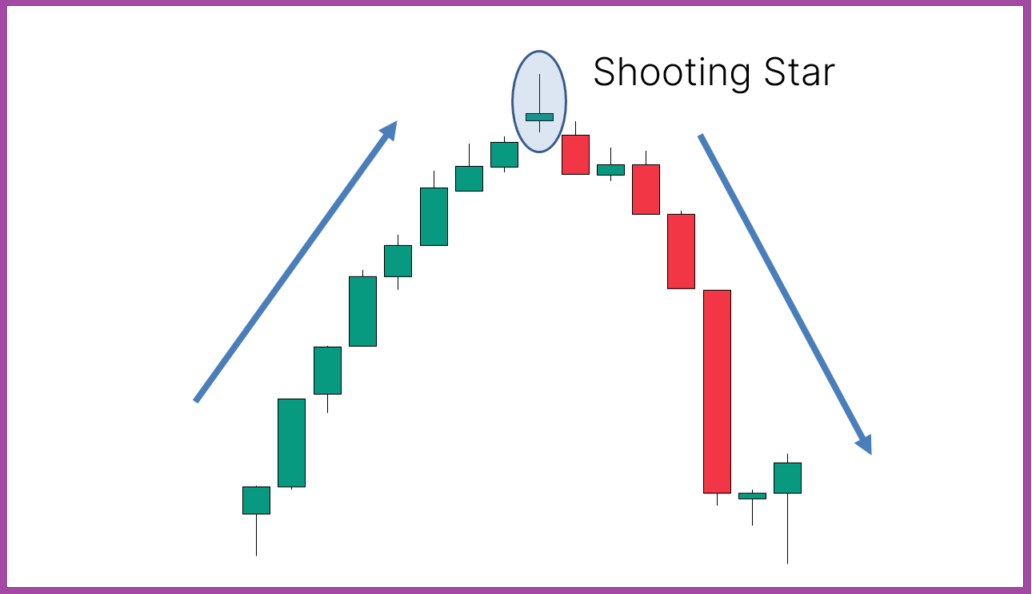

One of the prominent bearish reversal patterns is the Shooting Star. This detailed guide will explore the intricacies of the Shooting Star pattern, its formation, significance, and how traders can effectively utilize it in their trading strategies.

What is the Shooting Star Pattern?

The Shooting Star is a single-candlestick pattern that appears during an uptrend and signals a potential bearish reversal. The pattern is characterized by a small real body near the low of the price range and a long upper shadow. The long upper shadow indicates that the market tested higher levels but could not sustain them, leading to a close near the opening price.

Formation Criteria

For a Shooting Star pattern to be considered valid, it must meet the following criteria:

- The market should be in an uptrend.

- The candlestick should have a small real body near the lower end of the price range.

- There should be a long upper shadow, typically at least twice the length of the real body.

- The lower shadow should be either very small or non-existent.

Psychology Behind the Shooting Star Pattern

Understanding the psychology behind the Shooting Star pattern provides insights into its significance:

- Bullish Sentiment:

- The pattern starts with strong bullish sentiment, driving prices higher. The long upper shadow indicates that buyers tried to push the prices significantly up.

- Failure to Sustain Higher Levels:

- Despite the initial buying pressure, the market fails to sustain higher levels, and prices retreat towards the opening level. This reflects the emergence of selling pressure.

- Bearish Reversal Indication:

- The small real body near the lower end of the price range suggests indecision or weakening of the bullish trend. The inability to close near the highs and the long upper shadow signal a potential bearish reversal.

Significance of the Shooting Star Pattern

The Shooting Star pattern is significant for traders due to several reasons:

- Bearish Reversal Signal:

- It serves as a clear signal for a potential reversal from an uptrend to a downtrend, indicating a shift in market sentiment from bullish to bearish.

- Confirmation of Selling Pressure:

- The pattern confirms the presence of selling pressure, as indicated by the long upper shadow and the inability to close near the highs.

- Strategic Entry Point:

- The Shooting Star pattern presents an opportune entry point for traders looking to capitalize on the anticipated bearish reversal.

Trading Strategies Using the Shooting Star Pattern

Here are some strategies to effectively trade using the Shooting Star pattern:

- Wait for Confirmation:

- Always wait for confirmation before taking a position based on the Shooting Star pattern. Confirmation typically comes from a subsequent bearish candlestick that closes below the low of the Shooting Star.

- Combine with Other Indicators:

- Use other technical indicators, such as moving averages, RSI (Relative Strength Index), or MACD (Moving Average Convergence Divergence), to confirm the reversal signal given by the Shooting Star pattern. This helps increase the reliability of the signal.

- Identify Resistance Levels:

- Identify key resistance levels near the Shooting Star pattern. If the pattern forms near a strong resistance level, it reinforces the likelihood of a trend reversal.

- Set Stop-Loss Orders:

- Use stop-loss orders to manage risk. Place the stop-loss order above the high of the Shooting Star to protect against potential false signals.

- Plan Entry and Exit Points:

- Plan your entry and exit points based on the confirmation candle and nearby support levels. This helps in managing trades effectively and maximizing potential profits.

Example of the Shooting Star Pattern

Consider a stock that has been in an uptrend for several weeks. Here’s how the Shooting Star pattern might play out:

- Day 1 (Formation of Shooting Star):

- The stock opens at $100, moves up to a high of $110 during the day, but closes at $102, forming a small real body near the lower end of the price range with a long upper shadow.

The formation of this pattern signals a potential bearish reversal. Traders might enter short positions if the stock continues to show bearish movement in the following days.

Pros and Cons of the Shooting Star Pattern

Pros

- Clear Reversal Signal:

- The Shooting Star pattern provides a clear indication of a potential trend reversal, helping traders anticipate and prepare for market changes.

- Confirmation of Selling Pressure:

- The pattern offers valuable insights into market sentiment, showing that buying pressure is weakening and selling pressure is increasing.

- Strategic Entry Point:

- The pattern presents traders with a strategic entry point to capitalize on the anticipated bearish reversal, facilitating advantageous positioning in the market.

Cons

- Need for Confirmation:

- The Shooting Star pattern requires confirmation from subsequent candlesticks or technical indicators, which can delay the trading decision and potentially reduce profit margins.

- Potential for False Signals:

- Like any technical pattern, the Shooting Star can produce false signals, especially in volatile or choppy markets.

- Context Dependency:

- The effectiveness of the Shooting Star pattern depends on the broader market context and trend. Traders should use it in conjunction with other technical indicators and market analysis.

Practical Considerations for Trading the Shooting Star Pattern

- Volume Analysis:

- Analyzing volume can add confirmation to the Shooting Star pattern. Higher volume on the Shooting Star candlestick suggests stronger selling pressure and increases the pattern’s reliability.

- Market Conditions:

- Consider the broader market conditions. The Shooting Star pattern is more reliable in a clearly defined uptrend. In sideways or choppy markets, the pattern may be less effective.

- Multiple Timeframe Analysis:

- Use multiple timeframes to increase confidence in the pattern. For instance, a Shooting Star pattern on a daily chart confirmed by bearish signals on a weekly chart adds to the strength of the signal.

- Risk Management:

- Always use proper risk management techniques. The Shooting Star pattern, like any technical signal, is not foolproof. Protecting your capital with stop-loss orders and position sizing is crucial.

- Combine with Other Technical Tools:

- Enhance the pattern’s effectiveness by combining it with other technical tools such as trendlines, Fibonacci retracements, and momentum indicators. This holistic approach provides a more comprehensive view of market conditions.

Conclusion

The Shooting Star pattern is a powerful tool for traders looking to identify potential bearish reversals in an uptrend. By understanding its formation, significance, and psychological underpinnings, traders can make more informed decisions and improve their trading strategies. However, it’s essential to use the Shooting Star pattern in conjunction with other technical indicators and market analysis for confirmation and to mitigate the risk of false signals.

In essence, the Shooting Star pattern serves as a clear warning that the bullish momentum may be waning and a bearish reversal could be imminent. By practicing patience, diligence, and proper risk management, traders can effectively use this pattern to navigate the complexities of the financial markets and enhance their trading outcomes.

Remember, successful trading involves continuous learning and adaptation. By observing the Shooting Star pattern in real-market scenarios and refining your approach, you can develop a deeper understanding of market dynamics and position yourself advantageously in your trading endeavors.

EDUBRUG is a top educational institute known for offering the best stock market courses in India. Our goal is to make financial markets easy to understand and help people learn about trading. Eduburg has quickly become a popular choice for those who want to become successful traders and investors. Our experienced faculties, who are certified, provide practical training in stock trading, technical analysis, and financial planning. Eduburg is dedicated to providing high-quality education, ensuring that our students gain the skills and confidence needed to succeed in the stock market.