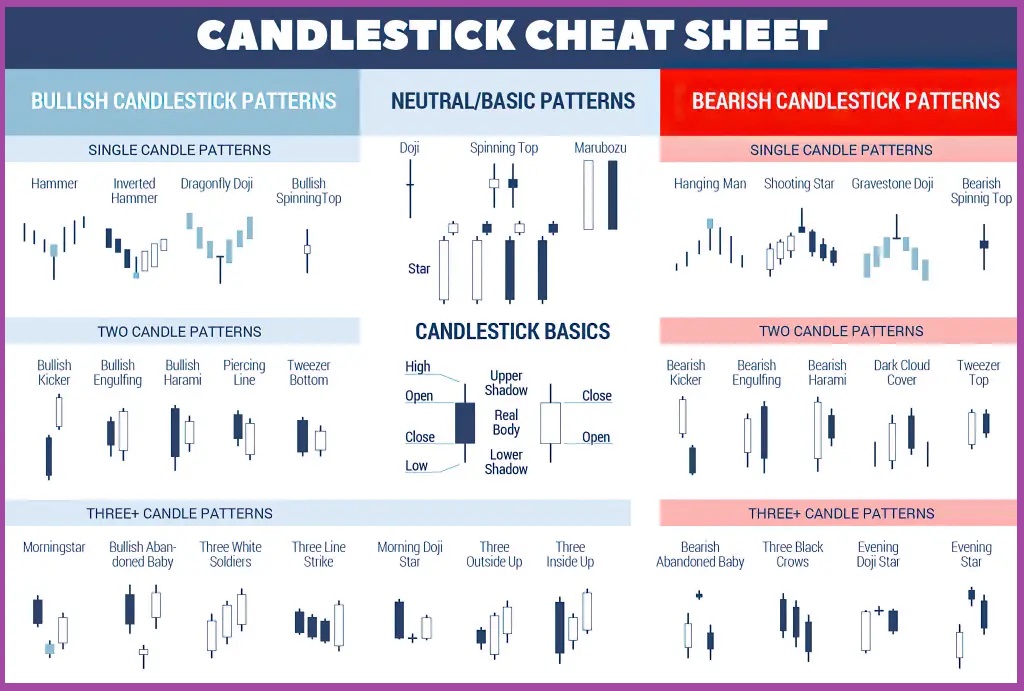

List of Top 100 Candlestick Patterns

Single Candlestick Patterns

- Long White Candlestick

- Description: A long white (or green) candlestick where the closing price is significantly higher than the opening price.

- Interpretation: Indicates strong buying pressure and bullish sentiment.

- Long Black Candlestick

- Description: A long black (or red) candlestick where the closing price is significantly lower than the opening price.

- Interpretation: Indicates strong selling pressure and bearish sentiment.

- Doji

- Description: A candlestick with a small body, where the opening and closing prices are nearly equal.

- Interpretation: Signals indecision in the market and potential trend reversal.

- Spinning Top

- Description: A candlestick with a small body and long upper and lower wicks, indicating indecision.

- Interpretation: Suggests a potential reversal or continuation depending on the preceding trend.

- Marubozu

- Description: A candlestick with no wicks, where the opening or closing price is also the high or low of the session.

- Interpretation: Indicates strong buying or selling pressure depending on whether it’s bullish or bearish.

- Hammer

- Description: A bullish reversal pattern characterized by a small body and a long lower wick.

- Interpretation: Signals potential trend reversal to the upside after a downtrend.

- Hanging Man

- Description: A bearish reversal pattern similar to a hammer but occurs after an uptrend.

- Interpretation: Signals potential weakness in the uptrend and a potential reversal to the downside.

- Shooting Star

- Description: A bearish reversal pattern characterized by a small body, a long upper wick, and little to no lower wick.

- Interpretation: Suggests potential exhaustion of the uptrend and a potential reversal to the downside.

- Inverted Hammer

- Description: A bullish reversal pattern with a small body, a long upper wick, and little to no lower wick.

- Interpretation: Signals potential trend reversal to the upside after a downtrend.

- Gravestone Doji

- Description: A doji with a long upper shadow and little to no lower shadow, indicating potential bearish reversal.

- Interpretation: Suggests potential exhaustion of the uptrend and a potential reversal to the downside.

- Dragonfly Doji

- Description: A doji with a long lower shadow and little to no upper shadow, indicating potential bullish reversal.

- Interpretation: Signals potential exhaustion of the downtrend and a potential reversal to the upside.

- Rickshaw Man

- Description: A doji with both upper and lower shadows of approximately equal length, indicating market indecision.

- Interpretation: Suggests potential trend reversal but requires confirmation from subsequent price action.

- Long-legged Doji

- Description: A doji with long upper and lower shadows, indicating high market volatility and uncertainty.

- Interpretation: Suggests potential trend reversal or continuation depending on subsequent price action.

- High-wave Candle

- Description: A candlestick with a long upper and lower shadow and a small body, indicating high market volatility.

- Interpretation: Suggests potential trend reversal or continuation depending on subsequent price action.

- Closing Marubozu

- Description: A marubozu where the closing price is also the high or low of the session.

- Interpretation: Indicates strong buying or selling pressure depending on whether it’s bullish or bearish.

- Opening Marubozu

- Description: A marubozu where the opening price is also the high or low of the session.

- Interpretation: Indicates strong buying or selling pressure depending on whether it’s bullish or bearish.

- Belt Hold Line

- Description: A single candlestick pattern where the opening price is the low (bullish) or the high (bearish) and the candlestick has no upper (bullish) or lower (bearish) shadow.

- Interpretation: Indicates a potential trend continuation.

- Counterattack Lines

- Description: A single candlestick pattern where a long white (black) candle is followed by a black (white) candle with similar opening and closing prices but opposite color.

- Interpretation: Signals a potential reversal of the previous trend.

- Harami Cross

- Description: A small candlestick that has both its open and close prices within the body of the previous candlestick.

- Interpretation: Suggests market indecision and potential reversal or continuation depending on subsequent price action.

- Engulfing Cross

- Description: A small candlestick that is engulfed by the subsequent candlestick, indicating a potential reversal.

- Interpretation: Signals a potential reversal of the previous trend.

- Doji Star

- Description: A small doji candlestick that gaps away from the previous candlestick, indicating potential market indecision.

- Interpretation: Suggests potential trend reversal or continuation depending on subsequent price action.

- Tri-Star Doji

- Description: Three consecutive doji candlesticks with decreasing size, indicating diminishing market volatility.

- Interpretation: Suggests potential trend reversal or continuation depending on subsequent price action.

- Advance Block

- Description: Three consecutive bullish candlesticks with progressively smaller bodies and higher closes.

- Interpretation: Signals potential exhaustion of the uptrend and a potential reversal to the downside.

- Descending Three Methods

- Description: A bearish continuation pattern where a long black candle is followed by small-bodied candlesticks that trade within the range of the first candle.

- Interpretation: Suggests potential continuation of the downtrend.

- Matching Low

- Description: Two consecutive candlesticks with equal or nearly equal lows, indicating potential support level.

- Interpretation: Suggests potential reversal or continuation depending on subsequent price action.

Double Candlestick Patterns

- Bullish Engulfing

- Description: A bullish reversal pattern where a small bearish candlestick is followed by a larger bullish candlestick that completely engulfs the previous one.

- Interpretation: Indicates a shift from bearish to bullish sentiment.

- Bearish Engulfing

- Description: A bearish reversal pattern where a small bullish candlestick is followed by a larger bearish candlestick that completely engulfs the previous one.

- Interpretation: Signals a shift from bullish to bearish sentiment.

- Bullish Harami

- Description: A bullish reversal pattern where a small bullish candlestick is engulfed by the previous bearish candlestick.

- Interpretation: Suggests a potential trend reversal.

- Bearish Harami

- Description: A bearish reversal pattern where a small bearish candlestick is engulfed by the previous bullish candlestick.

- Interpretation: Indicates a potential trend reversal to the downside.

- Piercing Line

- Description: A bullish reversal pattern where a long black candlestick is followed by a white candlestick that opens below the prior close but closes more than halfway into the prior black candlestick’s body.

- Interpretation: Signals a potential reversal of a downtrend.

- Dark Cloud Cover

- Description: A bearish reversal pattern where a long white candlestick is followed by a black candlestick that opens above the prior close but closes more than halfway into the prior white candlestick’s body.

- Interpretation: Suggests a potential reversal of an uptrend.

- Morning Star

- Description: A bullish reversal pattern comprising three candlesticks: a long bearish candlestick, a small-bodied candlestick (the star) gapping down, and a long bullish candlestick that opens above the star’s close.

- Interpretation: Indicates a potential trend reversal from bearish to bullish.

- Evening Star

- Description: A bearish reversal pattern comprising three candlesticks: a long bullish candlestick, a small-bodied candlestick (the star) gapping up, and a long bearish candlestick that opens below the star’s close.

- Interpretation: Signals a potential trend reversal from bullish to bearish.

- Bullish Kicker

- Description: A bullish reversal pattern where a black candlestick is followed by a white candlestick that opens lower and closes higher than the prior candlestick.

- Interpretation: Indicates a sudden shift from bearish to bullish sentiment.

- Bearish Kicker

- Description: A bearish reversal pattern where a white candlestick is followed by a black candlestick that opens higher and closes lower than the prior candlestick.

- Interpretation: Signals a sudden shift from bullish to bearish sentiment.

- Bullish Piercing

- Description: A bullish reversal pattern where a long black candlestick is followed by a white candlestick that closes above the midpoint of the prior black candlestick’s body.

- Interpretation: Suggests a potential reversal of a downtrend.

- Bearish Piercing

- Description: A bearish reversal pattern where a long white candlestick is followed by a black candlestick that closes below the midpoint of the prior white candlestick’s body.

- Interpretation: Indicates a potential reversal of an uptrend.

- Bullish Abandoned Baby

- Description: A bullish reversal pattern characterized by a gap down from the previous candlestick, followed by a doji, and then a gap up.

- Interpretation: Signals a potential reversal of a downtrend.

- Bearish Abandoned Baby

- Description: A bearish reversal pattern characterized by a gap up from the previous candlestick, followed by a doji, and then a gap down.

- Interpretation: Indicates a potential reversal of an uptrend.

- Bullish Belt Hold

- Description: A bullish reversal pattern where a long white candlestick opens at the low and closes near the high of the session.

- Interpretation: Indicates strong buying pressure and potential trend reversal.

- Bearish Belt Hold

- Description: A bearish reversal pattern where a long black candlestick opens at the high and closes near the low of the session.

- Interpretation: Indicates strong selling pressure and potential trend reversal.

- Bullish Meeting Lines

- Description: A bullish reversal pattern where a long black candlestick is followed by a long white candlestick with similar opening and closing prices.

- Interpretation: Signals a potential reversal of a downtrend.

- Bearish Meeting Lines

- Description: A bearish reversal pattern where a long white candlestick is followed by a long black candlestick with similar opening and closing prices.

- Interpretation: Indicates a potential reversal of an uptrend.

- Bullish Breakaway

- Description: A bullish reversal pattern where a series of small-bodied candlesticks is followed by a long white candlestick that gaps up from the previous close.

- Interpretation: Suggests a potential reversal of a downtrend.

- Bearish Breakaway

- Description: A bearish reversal pattern where a series of small-bodied candlesticks is followed by a long black candlestick that gaps down from the previous close.

- Interpretation: Indicates a potential reversal of an uptrend.

- Bullish Thrusting

- Description: A bullish reversal pattern where a long black candlestick is followed by a white candlestick that closes near but below the prior candlestick’s low.

- Interpretation: Suggests potential continuation of the uptrend.

- Bearish Thrusting

- Description: A bearish reversal pattern where a long white candlestick is followed by a black candlestick that closes near but above the prior candlestick’s high.

- Interpretation: Indicates potential continuation of the downtrend.

- Bullish Separating Lines

- Description: A bullish continuation pattern where a long white candlestick is followed by another long white candlestick with no overlap in the real bodies.

- Interpretation: Signals potential continuation of the uptrend.

- Bearish Separating Lines

- Description: A bearish continuation pattern where a long black candlestick is followed by another long black candlestick with no overlap in the real bodies.

- Interpretation: Indicates potential continuation of the downtrend.

- Bullish Tasuki Gap

- Description: A bullish continuation pattern where a long white candlestick is followed by a gap down and then another white candlestick that does not close the gap.

- Interpretation: Suggests potential continuation of the uptrend.

- **Bearish Tasuki

Gap** – Description: A bearish continuation pattern where a long black candlestick is followed by a gap up and then another black candlestick that does not close the gap. – Interpretation: Indicates potential continuation of the downtrend.

- Rising Three Methods

- Description: A bullish continuation pattern where a long white candlestick is followed by three small-bodied candlesticks that trade within the range of the first candle.

- Interpretation: Signals potential continuation of the uptrend.

- Falling Three Methods

- Description: A bearish continuation pattern where a long black candlestick is followed by three small-bodied candlesticks that trade within the range of the first candle.

- Interpretation: Indicates potential continuation of the downtrend.

- Bullish Side-by-Side White Lines

- Description: A bullish continuation pattern where two long white candlesticks have similar opening and closing prices, indicating strong buying pressure.

- Interpretation: Signals potential continuation of the uptrend.

- Bearish Side-by-Side White Lines

- Description: A bearish continuation pattern where two long black candlesticks have similar opening and closing prices, indicating strong selling pressure.

- Interpretation: Indicates potential continuation of the downtrend.

- Bullish Homing Pigeon

- Description: A bullish reversal pattern where a small black candlestick is followed by a larger white candlestick that opens below the prior close and closes within the prior candlestick’s body.

- Interpretation: Signals potential reversal of a downtrend.

- Bearish Homing Pigeon

- Description: A bearish reversal pattern where a small white candlestick is followed by a larger black candlestick that opens above the prior close and closes within the prior candlestick’s body.

- Interpretation: Indicates potential reversal of an uptrend.

- Bullish Stick Sandwich

- Description: A bullish reversal pattern where a long black candlestick is followed by a white candlestick, then another black candlestick that closes near the first candlestick’s close.

- Interpretation: Signals potential reversal of a downtrend.

- Bearish Stick Sandwich

- Description: A bearish reversal pattern where a long white candlestick is followed by a black candlestick, then another white candlestick that closes near the first candlestick’s close.

- Interpretation: Indicates potential reversal of an uptrend.

- Bullish Mat Hold

- Description: A bullish continuation pattern where a long white candlestick is followed by a gap down and then a series of small-bodied candlesticks that trade within the range of the first candle.

- Interpretation: Signals potential continuation of the uptrend.

- Bearish Mat Hold

- Description: A bearish continuation pattern where a long black candlestick is followed by a gap up and then a series of small-bodied candlesticks that trade within the range of the first candle.

- Interpretation: Indicates potential continuation of the downtrend.

- Bullish Ladder Bottom

- Description: A bullish reversal pattern characterized by a series of descending candlesticks with decreasing closes, followed by a long white candlestick.

- Interpretation: Signals potential reversal of a downtrend.

- Bearish Ladder Top

- Description: A bearish reversal pattern characterized by a series of ascending candlesticks with increasing closes, followed by a long black candlestick.

- Interpretation: Indicates potential reversal of an uptrend.

- Upside Gap Two Crows

- Description: A bearish reversal pattern where a long white candlestick is followed by a gap up and then two black candlesticks that open above the prior close and close within the prior white candlestick’s body.

- Interpretation: Signals potential reversal of an uptrend.

- Downside Gap Three Methods

- Description: A bearish continuation pattern where a long black candlestick is followed by a gap down and then a series of small-bodied candlesticks that trade within the range of the first candle.

- Interpretation: Indicates potential continuation of the downtrend.

These double candlestick patterns provide valuable insights into market sentiment and potential price movements. Traders often use them in conjunction with other technical indicators to make informed trading decisions. It’s essential to consider the overall market context and conduct thorough analysis before acting on any candlestick pattern signal.

Triple Candlestick Patterns

- Bullish Three-Line Strike

- Description: A bullish reversal pattern where three consecutive long black candlesticks are followed by a long white candlestick that closes above the highs of the three black candlesticks.

- Interpretation: Signals a potential reversal of a downtrend.

- Bearish Three-Line Strike

- Description: A bearish reversal pattern where three consecutive long white candlesticks are followed by a long black candlestick that closes below the lows of the three white candlesticks.

- Interpretation: Indicates a potential reversal of an uptrend.

- Bullish Three White Soldiers

- Description: A bullish reversal pattern where three consecutive long white candlesticks with small or no wicks appear, each opening within the previous candle’s body.

- Interpretation: Indicates strong buying pressure and potential continuation of an uptrend.

- Bearish Three Black Crows

- Description: A bearish reversal pattern where three consecutive long black candlesticks with small or no wicks appear, each opening within the previous candle’s body.

- Interpretation: Suggests strong selling pressure and potential continuation of a downtrend.

- Morning Star Doji

- Description: A bullish reversal pattern comprising three candlesticks: a long bearish candlestick, a small doji or spinning top (the star), and a long bullish candlestick that opens above the star’s close.

- Interpretation: Indicates a potential trend reversal from bearish to bullish.

- Evening Star Doji

- Description: A bearish reversal pattern comprising three candlesticks: a long bullish candlestick, a small doji or spinning top (the star), and a long bearish candlestick that opens below the star’s close.

- Interpretation: Signals a potential trend reversal from bullish to bearish.

- Bullish Tri-Star

- Description: A bullish reversal pattern characterized by three doji candlesticks in a row, with the middle doji gapping down from the preceding and succeeding candles.

- Interpretation: Suggests potential exhaustion of the downtrend and a potential reversal to the upside.

- Bearish Tri-Star

- Description: A bearish reversal pattern characterized by three doji candlesticks in a row, with the middle doji gapping up from the preceding and succeeding candles.

- Interpretation: Indicates potential exhaustion of the uptrend and a potential reversal to the downside.

- Morning Doji Star

- Description: A bullish reversal pattern similar to the morning star but with a doji or spinning top in the middle candle.

- Interpretation: Signals potential exhaustion of the downtrend and a potential reversal to the upside.

- Evening Doji Star

- Description: A bearish reversal pattern similar to the evening star but with a doji or spinning top in the middle candle.

- Interpretation: Indicates potential exhaustion of the uptrend and a potential reversal to the downside.

- Bullish Abandoned Baby Doji

- Description: A bullish reversal pattern characterized by a gap down from the previous candlestick, followed by a doji, and then a gap up.

- Interpretation: Signals potential reversal of a downtrend.

- Bearish Abandoned Baby Doji

- Description: A bearish reversal pattern characterized by a gap up from the previous candlestick, followed by a doji, and then a gap down.

- Interpretation: Indicates potential reversal of an uptrend.

- Bullish Breakaway Doji

- Description: A bullish reversal pattern where a series of small-bodied candlesticks is followed by a long white candlestick that gaps up from the previous close.

- Interpretation: Suggests a potential reversal of a downtrend.

- Bearish Breakaway Doji

- Description: A bearish reversal pattern where a series of small-bodied candlesticks is followed by a long black candlestick that gaps down from the previous close.

- Interpretation: Indicates a potential reversal of an uptrend.

- Bullish Ladder Bottom Doji

- Description: A bullish reversal pattern characterized by a series of descending candlesticks with decreasing closes, followed by a long white candlestick.

- Interpretation: Signals potential reversal of a downtrend.

- Bearish Ladder Top Doji

- Description: A bearish reversal pattern characterized by a series of ascending candlesticks with increasing closes, followed by a long black candlestick.

- Interpretation: Indicates potential reversal of an uptrend.

- Upside Gap Two Crows Doji

- Description: A bearish reversal pattern where a long white candlestick is followed by a gap up and then two black candlesticks that open above the prior close and close within the prior white candlestick’s body.

- Interpretation: Signals potential reversal of an uptrend.

- Downside Gap Three Methods Doji

- Description: A bearish continuation pattern where a long black

candlestick is followed by a gap down and then a series of small-bodied candlesticks that trade within the range of the first candle. – Interpretation: Indicates potential continuation of the downtrend.

- Bullish Meeting Lines Doji

- Description: A bullish reversal pattern where a long black candlestick is followed by a long white candlestick with similar opening and closing prices.

- Interpretation: Signals a potential reversal of a downtrend.

- Bearish Meeting Lines Doji

- Description: A bearish reversal pattern where a long white candlestick is followed by a long black candlestick with similar opening and closing prices.

- Interpretation: Indicates a potential reversal of an uptrend.

- Three Black Crows Doji

- Description: A bearish reversal pattern where three consecutive long black candlesticks with small or no wicks appear.

- Interpretation: Suggests strong selling pressure and potential continuation of a downtrend.

- Three Inside Down Doji

- Description: A bearish reversal pattern where a long white candlestick is followed by a black candlestick that is engulfed by the prior white candlestick.

- Interpretation: Indicates potential reversal of an uptrend.

- Three Inside Up Doji

- Description: A bullish reversal pattern where a long black candlestick is followed by a white candlestick that is engulfed by the prior black candlestick.

- Interpretation: Signals potential reversal of a downtrend.

- Three Outside Down Doji

- Description: A bearish reversal pattern where a long white candlestick is followed by a black candlestick that completely engulfs the prior white candlestick.

- Interpretation: Indicates potential reversal of an uptrend.

- Three Outside Up Doji

- Description: A bullish reversal pattern where a long black candlestick is followed by a white candlestick that completely engulfs the prior black candlestick.

- Interpretation: Suggests potential reversal of a downtrend.

These triple candlestick patterns offer traders insights into market sentiment and potential reversals. As with any technical analysis tool, it’s essential to confirm signals with other indicators and consider the overall market context before making trading decisions.

- Tweezer Top

- Description: A bearish reversal pattern where two consecutive candlesticks have similar highs, indicating potential resistance.

- Interpretation: Signals potential exhaustion of an uptrend and a potential reversal to the downside.

- Tweezer Bottom

- Description: A bullish reversal pattern where two consecutive candlesticks have similar lows, indicating potential support.

- Interpretation: Indicates potential exhaustion of a downtrend and a potential reversal to the upside.

- Harami Cross

- Description: A small candlestick that has both its open and close prices within the body of the previous candlestick.

- Interpretation: Suggests market indecision and potential reversal or continuation depending on subsequent price action.

- Engulfing Cross

- Description: A small candlestick that is engulfed by the subsequent candlestick, indicating a potential reversal.

- Interpretation: Signals a potential reversal of the previous trend.

- Doji Star

- Description: A small doji candlestick that gaps away from the previous candlestick, indicating potential market indecision.

- Interpretation: Suggests potential trend reversal or continuation depending on subsequent price action.

- Tri-Star Doji

- Description: Three consecutive doji candlesticks with decreasing size, indicating diminishing market volatility.

- Interpretation: Suggests potential trend reversal or continuation depending on subsequent price action.

- Advance Block

- Description: Three consecutive bullish candlesticks with progressively smaller bodies and higher closes.

- Interpretation: Signals potential exhaustion of the uptrend and a potential reversal to the downside.

- Descending Three Methods

- Description: A bearish continuation pattern where a long black candle is followed by small-bodied candlesticks that trade within the range of the first candle.

- Interpretation: Suggests potential continuation of the downtrend.

- Gravestone Doji Dragonfly Doji

- Description: A doji with a long upper shadow and little to no lower shadow, indicating potential bearish reversal.

- Interpretation: Suggests potential exhaustion of the uptrend and a potential reversal to the downside.

- Matching Low

- Description: Two consecutive candlesticks with equal or nearly equal lows, indicating potential support level.

- Interpretation: Suggests potential reversal or continuation depending on subsequent price action.

- Upside Tasuki Gap

- Description: A bullish continuation pattern where a gap separates two consecutive bullish candlesticks in an uptrend.

- Interpretation: Indicates potential continuation of the uptrend.

- Downside Tasuki Gap

- Description: A bearish continuation pattern where a gap separates two consecutive bearish candlesticks in a downtrend.

- Interpretation: Suggests potential continuation of the downtrend.

- Upside Gap Three Methods

- Description: A bullish continuation pattern where a long white candlestick is followed by small-bodied candlesticks that trade within the range of the first candle.

- Interpretation: Signals potential continuation of the uptrend.

- Downside Gap Two Crows

- Description: A bearish reversal pattern where a long white candlestick is followed by a gap up and then two black candlesticks that open above the prior close and close within the prior white candlestick’s body.

- Interpretation: Signals potential reversal of an uptrend.

- Three Methods

- Description: A bullish continuation pattern where a long white (or black) candlestick is followed by smaller-bodied candlesticks that trade within the range of the first candle.

- Interpretation: Indicates potential continuation of the uptrend (or downtrend).

- Three Stars in the South

- Description: A bearish reversal pattern where three consecutive long white candlesticks appear, each with a higher close than the previous one.

- Interpretation: Indicates potential exhaustion of the uptrend and a potential reversal to the downside.

- Unique Three River Bottom

- Description: A bullish reversal pattern where a long black candlestick is followed by three consecutive white candlesticks, each opening within the body of the previous candlestick.

- Interpretation: Signals potential reversal of a downtrend.

- Unique Three Mountain Top

- Description: A bearish reversal pattern where a long white candlestick is followed by three consecutive black candlesticks, each opening within the body of the previous candlestick.

- Interpretation: Indicates potential reversal of an uptrend.

- Three River Bottom

- Description: A bullish reversal pattern where a long black candlestick is followed by three consecutive white candlesticks, each with a higher close than the previous one.

- Interpretation: Signals potential reversal of a downtrend.

- Three Mountain Top

- Description: A bearish reversal pattern where a long white candlestick is followed by three consecutive black candlesticks, each with a lower close than the previous one.

- Interpretation: Indicates potential reversal of an uptrend.

- Unique Three Mountain Bottom

- Description: A bullish reversal pattern where a long black candlestick is followed by three consecutive white candlesticks, each opening within the body of the previous candlestick.

- Interpretation: Signals potential reversal of a downtrend.

- Three Mountains Bottom

- Description: A bullish reversal pattern where three consecutive black candlesticks appear, each with a lower close than the previous one.

- Interpretation: Indicates potential exhaustion of the downtrend and a potential reversal to the upside.

- Three Inside Up

- Description: A bullish reversal pattern where a long black candlestick is followed by a white candlestick that is engulfed by the prior black candlestick.

- Interpretation: Signals potential reversal of a downtrend.

- Three Outside Down

- Description: A bearish reversal pattern where a long white candlestick is followed by a black candlestick that completely engulfs the prior white candlestick.

- Interpretation: Indicates potential reversal of an uptrend.

- Three Stars in the North

- Description: A bullish reversal pattern where three consecutive long black candlesticks appear, each with a lower close than the previous one.

- Interpretation: Signals potential exhaustion of the downtrend and a potential reversal to the upside.

- Three Soldiers

- Description: A bullish reversal pattern where three consecutive long white candlesticks appear, each with a higher close than the previous one.

- Interpretation: Indicates strong buying pressure and potential continuation of an uptrend.

- Three Advancing White Soldiers

- Description: A bullish reversal pattern where three consecutive long white candlesticks appear, each opening within the previous candle’s body and closing near the high.

- Interpretation: Signals strong buying pressure and potential continuation of an uptrend.

- Three Declining Black Crows

- Description: A bearish reversal pattern where three consecutive long black candlesticks appear, each opening within the previous candle’s body and closing near the low.

- Interpretation: Suggests strong selling pressure and potential continuation of a downtrend.

- Three Inside

- Description: A bullish reversal pattern where a long black candlestick is followed by a white candlestick that is engulfed by the prior black candlestick.

- Interpretation: Signals potential reversal of a downtrend.

- Three-Line Strike

- Description: A bullish reversal pattern where three consecutive candlesticks are formed, with the third candlestick closing above the first candlestick’s open in an uptrend or below the first candlestick’s open in a downtrend.

- Interpretation: Indicates potential exhaustion of the prevailing trend and a potential reversal.

- Three White Soldiers

- Description: A bullish reversal pattern where three consecutive long white candlesticks appear, each opening within the body of the previous candlestick.

- Interpretation: Signals strong buying pressure and potential continuation of an uptrend.

- Three Black Crows

- Description: A bearish reversal pattern where three consecutive long black candlesticks appear, each opening within the body of the previous candlestick.

- Interpretation: Suggests strong selling pressure and potential continuation of a downtrend.

- Three Inside Up

- Description: A bullish reversal pattern where a long black candlestick is followed by a white candlestick that is engulfed by the prior black candlestick.

- Interpretation: Signals potential reversal of a downtrend.

- Three Outside Up

- Description: A bullish reversal pattern where a long black candlestick is followed by a white candlestick that completely engulfs the prior black candlestick.

- Interpretation: Indicates potential reversal of a downtrend.

- Three Inside Down – Description: A bearish reversal pattern where a long white candlestick is followed by a black candlestick that is engulfed by the prior white candlestick. – Interpretation: Signals potential reversal of an uptrend.

These candlestick patterns offer valuable insights into market sentiment and potential price movements. Traders often use them in conjunction with other technical indicators and analysis methods to make informed trading decisions. However, it’s essential to remember that no pattern guarantees a specific outcome, and traders should always consider the overall market context and risk management strategies before making trading decisions.

EDUBRUG is a top educational institute known for offering the best stock market courses in India. Our goal is to make financial markets easy to understand and help people learn about trading. Eduburg has quickly become a popular choice for those who want to become successful traders and investors. Our experienced faculties, who are certified, provide practical training in stock trading, technical analysis, and financial planning. Eduburg is dedicated to providing high-quality education, ensuring that our students gain the skills and confidence needed to succeed in the stock market.