The Piercing Candlestick Pattern: A Comprehensive Guide

Introduction

The Piercing candlestick pattern is a significant indicator in technical analysis, used by traders to identify potential bullish reversals in the market. Recognized for its reliability, the Piercing pattern provides insights into market sentiment and possible price movements. This article will explore the anatomy of the Piercing pattern, the psychology behind its formation, its significance in trading, and strategies for its effective use.

Anatomy of the Piercing Pattern

The Piercing pattern is a two-candle formation that appears during a downtrend and signals a potential bullish reversal. It consists of:

- First Candle (Bearish Candle):

- Description: The first candle is a long bearish candle, indicating strong selling pressure and continuation of the downtrend.

- Implication: It reflects the prevailing bearish sentiment in the market.

- Second Candle (Bullish Candle):

- Description: The second candle is a bullish candle that opens below the low of the first candle but closes above the midpoint of the first candle’s body.

- Implication: This candle shows a strong buying interest that reverses a significant portion of the previous day’s losses.

Formation Criteria

For a Piercing pattern to be valid, the following criteria must be met:

- The market should be in a downtrend.

- The second candle must open below the low of the first candle.

- The second candle must close above the midpoint of the first candle’s body.

Psychology Behind the Piercing Pattern

The Piercing pattern reflects a change in market sentiment from bearish to bullish. Here’s the psychological journey behind its formation:

- Continuation of Downtrend: The first bearish candle reinforces the existing downtrend, with sellers in control.

- Gap Down Opening: The second candle opens lower, continuing the bearish sentiment.

- Strong Buying Pressure: Buyers step in aggressively, pushing the price higher and closing above the midpoint of the first candle. This reversal of sentiment indicates that buyers are gaining control.

This shift in momentum suggests that the selling pressure is weakening and a bullish reversal may be on the horizon.

Significance of the Piercing Pattern in Trading

The Piercing pattern is significant for several reasons:

- Reversal Indicator: It serves as a potential reversal signal at the bottom of a downtrend, providing traders with an opportunity to enter long positions.

- **Shift in Market Sent

iment**: It indicates a clear shift in market sentiment from bearish to bullish, reflecting increased buying pressure. 3. Confirmation of Support Levels: When the Piercing pattern forms near a key support level, it strengthens the likelihood of a bullish reversal.

- Reliability with Volume: The reliability of the Piercing pattern increases when accompanied by high trading volume, indicating strong participation by buyers.

Trading Strategies Involving Piercing Patterns

To effectively trade using the Piercing pattern, consider the following strategies:

- Confirmation with Follow-Up Candles:

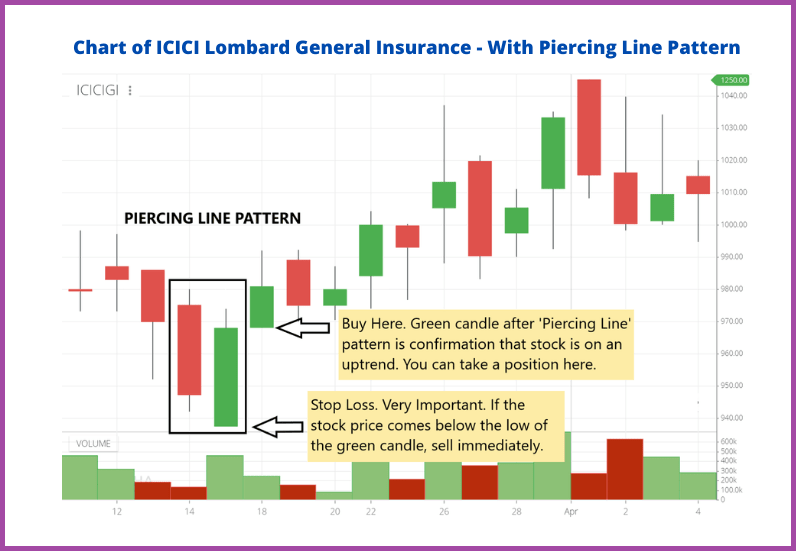

- Strategy: Wait for the next candle to confirm the reversal. A bullish candle following the Piercing pattern strengthens the reversal signal.

- Example: After identifying a Piercing pattern, observe the next trading day. If it closes higher, it confirms the bullish reversal, suggesting an entry point for a long position.

- Support Levels:

- Strategy: Identify Piercing patterns forming near key support levels. This confluence increases the pattern’s reliability.

- Example: A Piercing pattern forming at a historical support level provides a stronger reversal signal, suggesting a higher probability of a successful trade.

- Volume Analysis:

- Strategy: Confirm the Piercing pattern with volume analysis. Higher volume on the second candle indicates strong buyer interest.

- Example: A Piercing pattern accompanied by a spike in volume suggests significant buying pressure, reinforcing the reversal signal.

- Moving Averages:

- Strategy: Use moving averages to confirm the overall trend. A Piercing pattern forming near a long-term moving average can indicate a potential reversal point.

- Example: A Piercing pattern appearing near the 200-day moving average provides a stronger buy signal, indicating a potential trend reversal.

Practical Example of the Piercing Pattern

Consider a stock in a downtrend, forming several consecutive bearish candles. On a particular day, the stock opens lower than the previous day’s close, forming a gap down. However, significant buying pressure pushes the price up, and the stock closes above the midpoint of the previous day’s bearish candle, forming a Piercing pattern. The next day, the stock opens higher and continues to rise, confirming the bullish reversal. Accompanied by high trading volume and forming near a support level, this Piercing pattern signals a strong buy opportunity.

Pros and Cons of the Piercing Pattern

Pros

- Strong Reversal Signal:

- Pro: The Piercing pattern is a reliable indicator of a potential reversal from a downtrend to an uptrend. Its clear shift from bearish to bullish sentiment can provide a strong signal that the downtrend may be ending and an uptrend might be starting.

- Easy Identification:

- Pro: The Piercing candlestick is visually distinctive and easy to spot on a chart, even for novice traders. Its two-candle formation makes it easily recognizable.

- Indicates Buyer Strength:

- Pro: The pattern indicates a significant rejection of lower prices and strong buying interest. This reflects a shift in market sentiment from bearish to bullish, which can be a precursor to a price increase.

- Enhanced Reliability with Volume:

- Pro: When the Piercing pattern is accompanied by high trading volume, its reliability as a reversal signal increases. High volume suggests strong participation by buyers, reinforcing the pattern’s significance.

- Versatility Across Markets:

- Pro: The Piercing pattern can be applied across various financial markets, including stocks, forex, commodities, and cryptocurrencies. This makes it a versatile tool for traders in different markets.

Cons

- Requires Confirmation:

- Con: A single Piercing pattern does not guarantee a trend reversal. Traders need to wait for confirmation from subsequent price action or additional technical indicators to validate the signal and avoid false positives.

- Potential for False Signals:

- Con: The Piercing pattern can sometimes produce false signals, especially in volatile or choppy markets. This can lead to premature entries into trades that may not result in the expected reversal.

- Context Dependence:

- Con: The effectiveness of the Piercing pattern depends on its context within the broader market trend and conditions. Without considering the overall trend and other technical factors, traders might misinterpret the pattern.

- Limited Predictive Power in Isolation:

- Con: While the Piercing pattern indicates a potential reversal, it does not provide information about the extent or duration of the new trend. It should be used as part of a broader analysis rather than in isolation.

- Requires Additional Analysis:

- Con: To increase the reliability of the Piercing pattern, traders often need to combine it with other technical analysis tools and indicators. This additional analysis can complicate the trading strategy, especially for beginners.

Conclusion

The Piercing candlestick pattern is a valuable tool in technical analysis, offering clear signals of potential trend reversals from downtrends to uptrends. Its ease of identification and implications for market sentiment make it a popular choice among traders. However, like any trading tool, it has its limitations. The pattern requires confirmation from additional indicators and analysis to mitigate the risk of false signals and ensure more accurate trading decisions. By understanding the pros and cons of the Piercing pattern, traders can effectively incorporate it into their trading strategies for better outcomes.

EDUBRUG is a top educational institute known for offering the best stock market courses in India. Our goal is to make financial markets easy to understand and help people learn about trading. Eduburg has quickly become a popular choice for those who want to become successful traders and investors. Our experienced faculties, who are certified, provide practical training in stock trading, technical analysis, and financial planning. Eduburg is dedicated to providing high-quality education, ensuring that our students gain the skills and confidence needed to succeed in the stock market.