The White Marubozu Candlestick Pattern: A Comprehensive Guide

Introduction

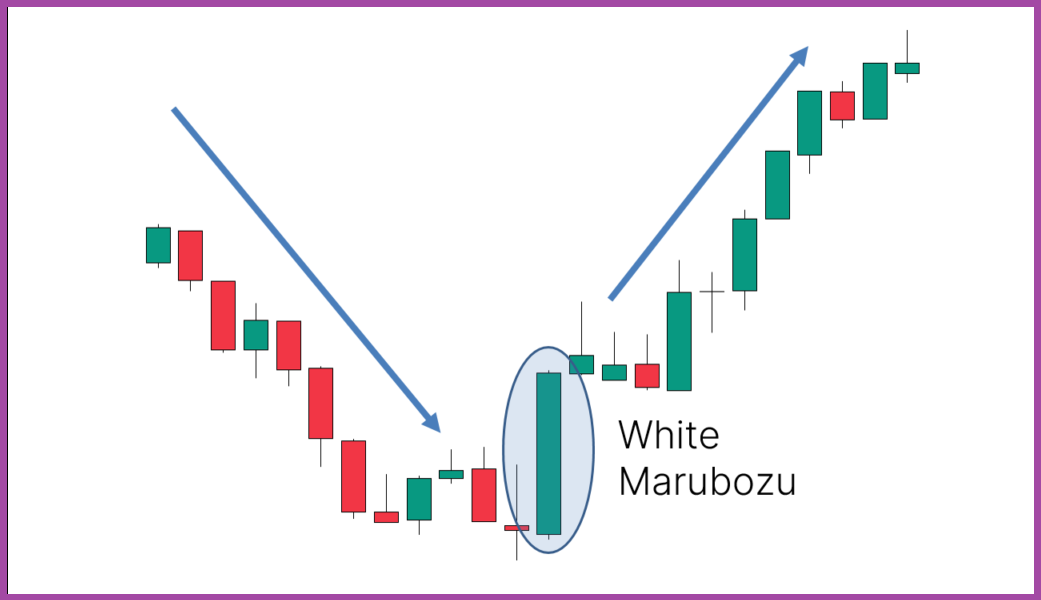

The White Marubozu candlestick pattern is a prominent and powerful indicator in technical analysis, signaling strong bullish momentum. Recognized for its straightforward appearance and clear implications, the White Marubozu is a favorite among traders for identifying potential bullish trends and continuation patterns. This article will explore the anatomy of the White Marubozu pattern, the psychology behind its formation, its significance in trading, and strategies for its effective use.

Anatomy of the White Marubozu Pattern

The White Marubozu is characterized by a single long bullish candlestick with no shadows. This candlestick has specific features that make it easily identifiable:

- Long Bullish Body:

- The candlestick has a long white (or green) body, indicating that the closing price is significantly higher than the opening price.

- No Upper Shadow:

- The absence of an upper shadow means that the price did not encounter significant resistance and continued to rise until the close.

- No Lower Shadow:

- The absence of a lower shadow means that the opening price was the lowest price of the session, indicating strong buying interest from the outset.

Formation Criteria

For a White Marubozu pattern to be considered valid, the following criteria must be met:

- Long Bullish Body: The candlestick must have a long bullish body, showing a significant price increase from open to close.

- No Shadows: The candlestick should not have any upper or lower shadows, indicating unchallenged buying pressure throughout the trading session.

Psychology Behind the White Marubozu Pattern

The White Marubozu pattern reflects unchallenged buying pressure and strong bullish sentiment. Here’s the psychological journey behind its formation:

- Strong Opening:

- The trading session begins with a strong opening price that remains the lowest price of the session, indicating immediate buying interest.

- Sustained Buying Pressure:

- Throughout the session, buyers maintain control, pushing the price higher without encountering significant resistance.

- Bullish Close:

- The session ends at the highest price of the day, showing that buyers were dominant from open to close, with no retracement.

This clear and sustained buying pressure suggests that the bulls are in control, and the price is likely to continue rising.

Significance of the White Marubozu in Trading

The White Marubozu pattern is significant for several reasons:

- Strong Bullish Signal:

- The pattern is a strong indicator of bullish momentum, providing traders with an opportunity to enter long positions.

- Trend Continuation or Reversal:

- In an uptrend, a White Marubozu confirms the continuation of the bullish trend. In a downtrend, it can signal a potential bullish reversal.

- Market Sentiment Indicator:

- It indicates strong and unchallenged buying pressure, reflecting a shift or reinforcement of bullish sentiment in the market.

- Volume Confirmation:

- The reliability of the White Marubozu pattern increases when accompanied by high trading volume, indicating strong participation by buyers.

Trading Strategies Involving White Marubozu

To effectively trade using the White Marubozu pattern, consider the following strategies:

- Trend Confirmation:

- Strategy: Use the White Marubozu to confirm the direction of the prevailing trend. In an uptrend, it signals continuation; in a downtrend, it suggests a potential reversal.

- Example: If a White Marubozu forms during an uptrend, it confirms the strength of the trend, providing an opportunity to add to long positions.

- Volume Analysis:

- Strategy: Confirm the White Marubozu with high trading volume, which indicates strong buying interest.

- Example: After identifying a White Marubozu, check the volume. High volume reinforces the pattern’s reliability and the strength of the bullish signal.

- Support and Resistance Levels:

- Strategy: Look for White Marubozu patterns forming near key support or resistance levels. This confluence increases the pattern’s reliability.

- Example: A White Marubozu forming at a historical support level provides a stronger reversal signal, suggesting a higher probability of a successful trade.

- Moving Averages:

- Strategy: Use moving averages to confirm the overall trend. A White Marubozu forming near a long-term moving average can indicate a potential continuation or reversal point.

- Example: A White Marubozu pattern appearing near the 200-day moving average provides a stronger buy signal, indicating a potential trend continuation or reversal.

Practical Example of the White Marubozu Pattern

Consider a stock that has been in a downtrend. On a particular day, the stock opens at its lowest price of the session and closes at its highest price, forming a long bullish candlestick with no shadows. This White Marubozu pattern, accompanied by high trading volume and forming near a support level, signals a strong buy opportunity. Traders can enter a long position at the close of the White Marubozu candlestick, with a stop-loss set below the opening price to manage risk.

Pros and Cons of the White Marubozu Pattern

Pros

- Strong Bullish Signal:

- Pro: The White Marubozu pattern is a reliable indicator of strong bullish momentum. Its clear and unchallenged buying pressure can provide a strong signal that the price is likely to continue rising.

- Easy Identification:

- Pro: The White Marubozu candlestick is visually distinctive and easy to spot on a chart, even for novice traders. Its single-candle formation makes it easily recognizable.

- Indicates Sustained Buyer Strength:

- Pro: The pattern indicates sustained and strong buying interest throughout the trading session. This reflects a clear shift in market sentiment from bearish to bullish, which can be a precursor to a price increase.

- Enhanced Reliability with Volume:

- Pro: When the White Marubozu pattern is accompanied by high trading volume, its reliability as a bullish signal increases. High volume suggests strong participation by buyers, reinforcing the pattern’s significance.

- Versatility Across Markets:

- Pro: The White Marubozu pattern can be applied across various financial markets, including stocks, forex, commodities, and cryptocurrencies. This makes it a versatile tool for traders in different markets.

Cons

- Potential for Overextension:

- Con: The White Marubozu pattern can sometimes indicate an overextended move, leading to a potential short-term pullback before the uptrend resumes. Traders need to be cautious and manage risk appropriately.

- Context Dependence:

- Con: The effectiveness of the White Marubozu pattern depends on its context within the broader market trend and conditions. Without considering the overall trend and other technical factors, traders might misinterpret the pattern.

- Limited Predictive Power in Isolation:

- Con: While the White Marubozu pattern indicates strong bullish momentum, it does not provide information about the extent or duration of the new trend. It should be used as part of a broader analysis rather than in isolation.

- Requires Additional Analysis:

- Con: To increase the reliability of the White Marubozu pattern, traders often need to combine it with other technical analysis tools and indicators. This additional analysis can complicate the trading strategy, especially for beginners.

Conclusion

The White Marubozu candlestick pattern is a powerful indicator of strong bullish momentum, offering traders clear insights into market sentiment shifts. Its single-candle formation makes it easy to identify, and its implications for a trend continuation or reversal provide valuable signals for entering long positions. However, traders should be aware of its limitations, including the need for context and potential overextension. By combining the White Marubozu pattern with other technical analysis tools and considering the broader market context, traders can effectively incorporate it into their strategies to enhance their trading outcomes.

EDUBRUG is a top educational institute known for offering the best stock market courses in India. Our goal is to make financial markets easy to understand and help people learn about trading. Eduburg has quickly become a popular choice for those who want to become successful traders and investors. Our experienced faculties, who are certified, provide practical training in stock trading, technical analysis, and financial planning. Eduburg is dedicated to providing high-quality education, ensuring that our students gain the skills and confidence needed to succeed in the stock market.